Client & Product Onboarding

multi:onboard

Digital corporate client onboarding – according to the bank’s needs

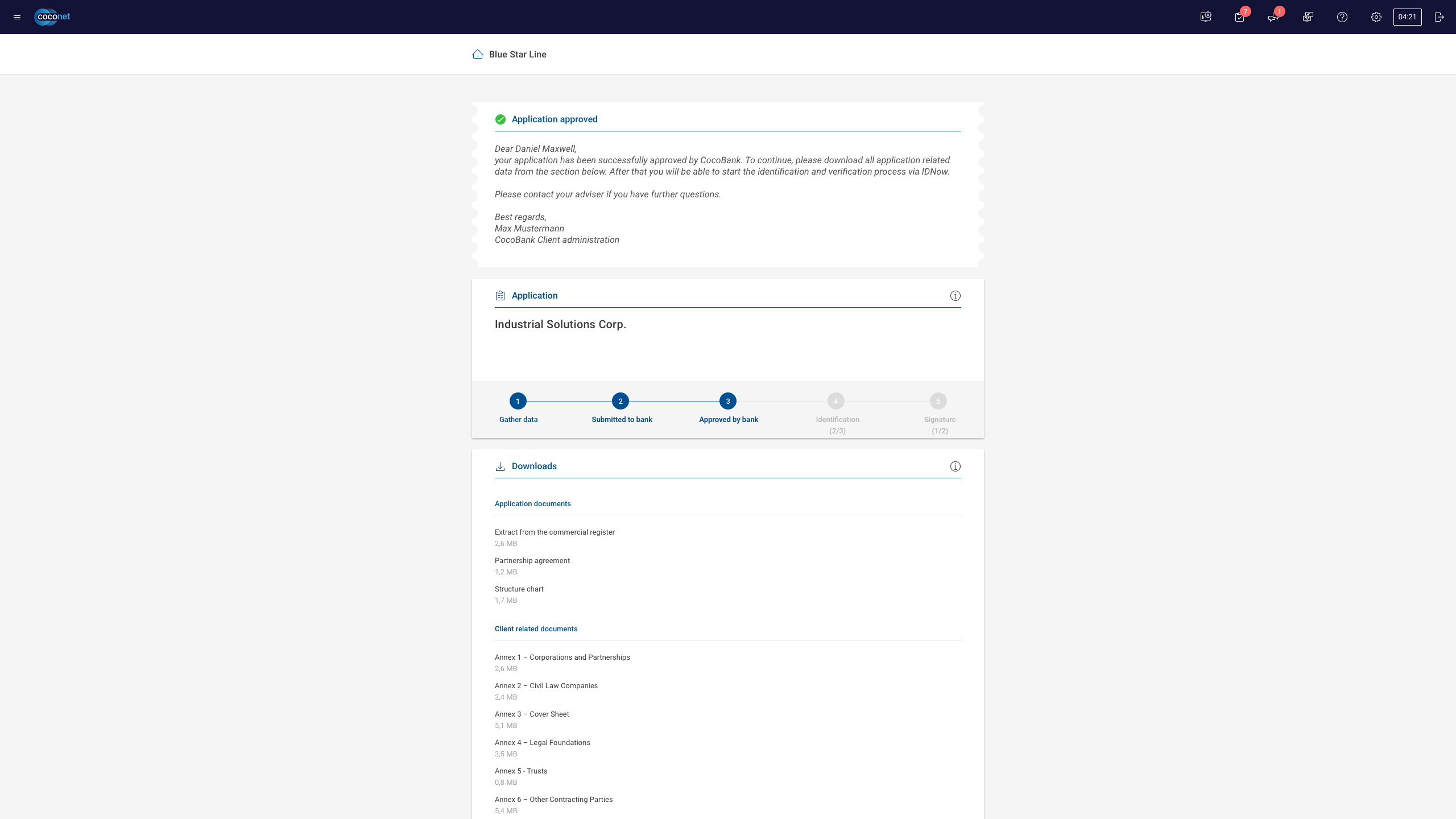

Bring your clients on board even more quickly with multi:onboard. The fully digital onboarding workflow, including user interaction and KYC, creates a new gateway into your bank’s environment. It has universal use and can be scaled for different target groups, countries and corporate structures.

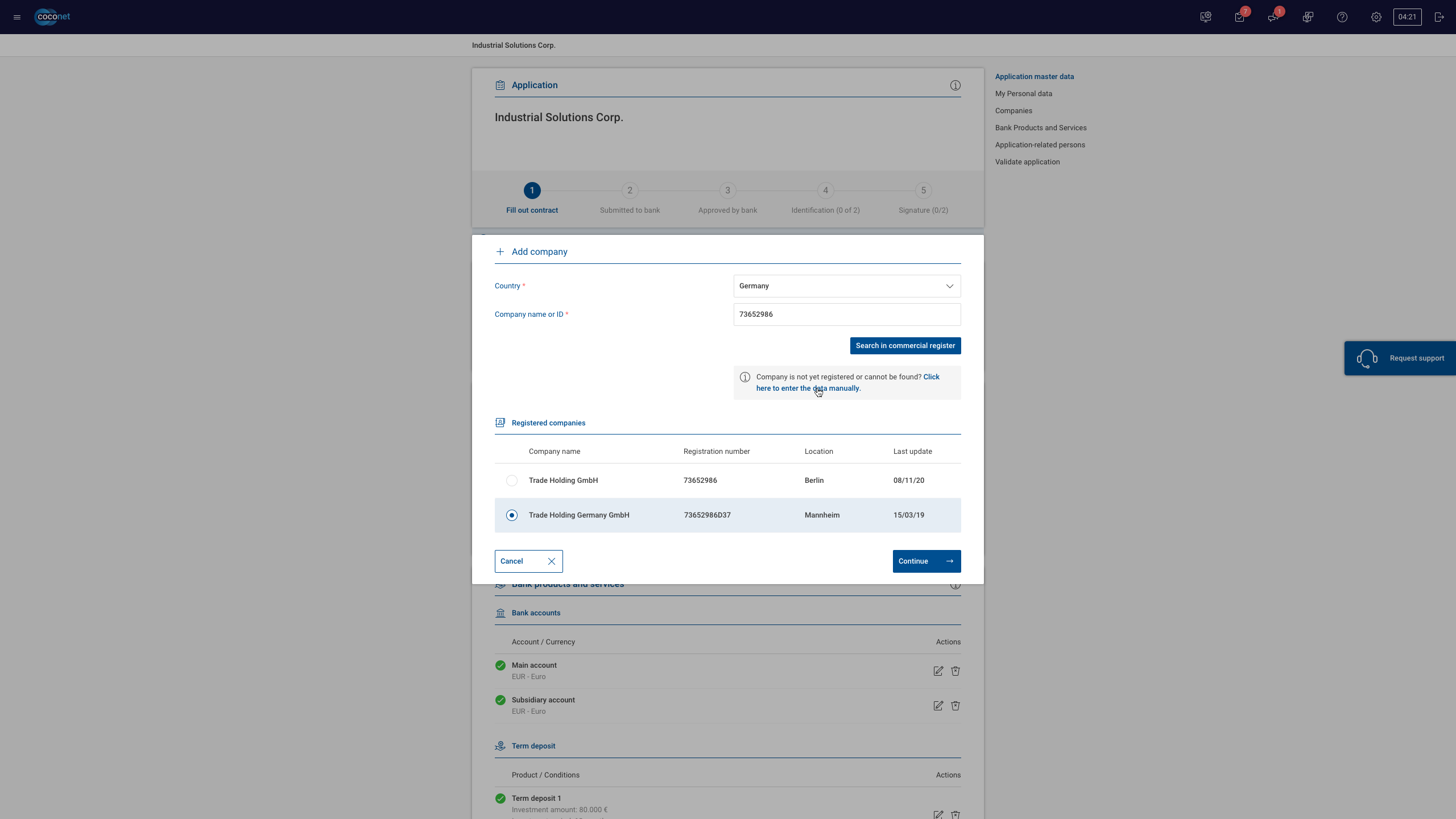

multi:onboard not only creates legal security based on comprehensive validation and document checking but also makes life easier for your clients, for example by automatically obtaining company and personal data from public records. Start tomorrow into the age of paperless onboarding!

multi:onboard offers:

- modular, fully digital onboarding for your clients that can be tailored to your needs

- incorporation into existing workflow engines for seamless integration

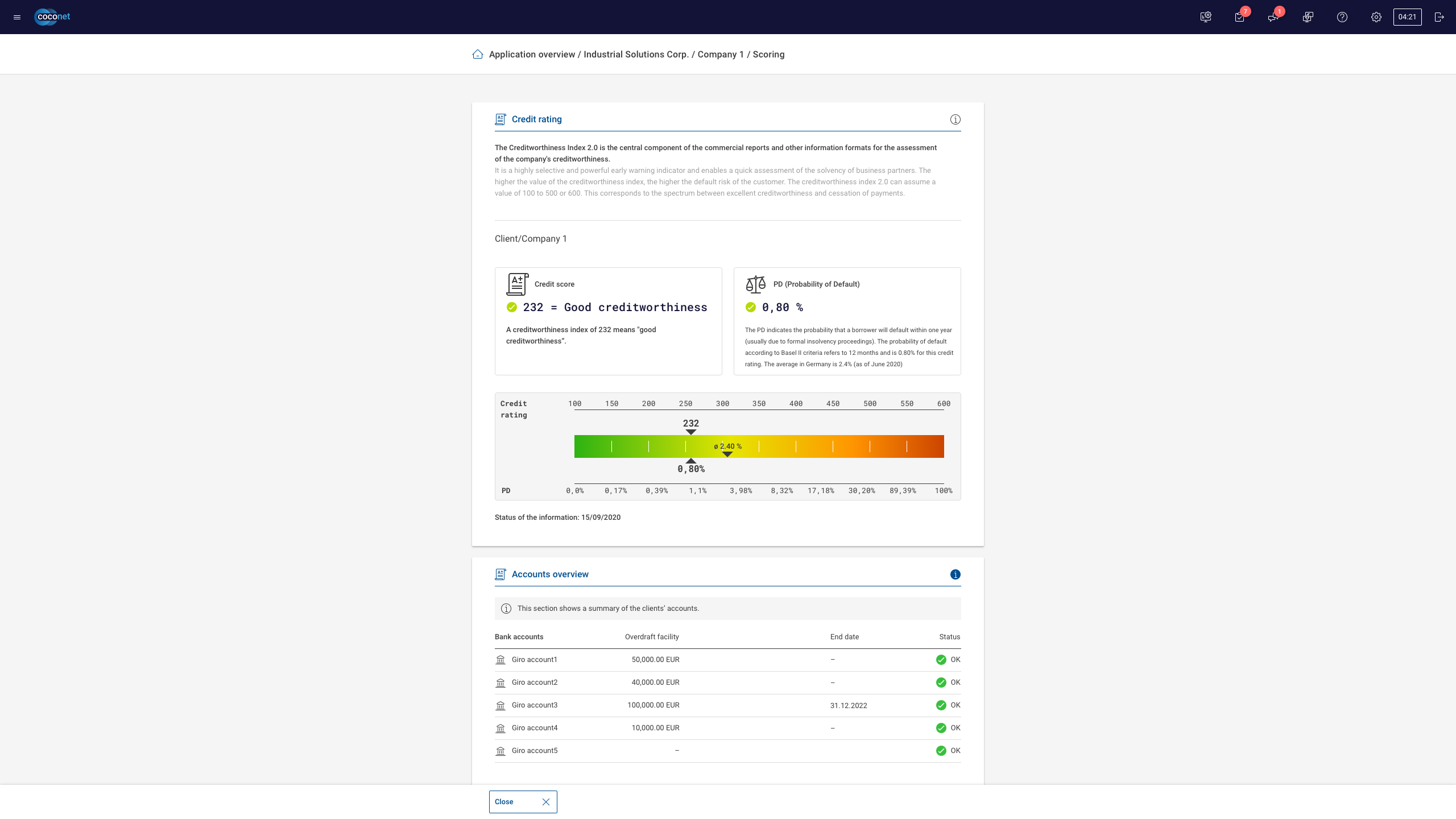

- aggregation of data from bank-internal and external data sources such as registries and credit agencies

- integration of our Customer Analytics Module for process monitoring or identification of process bottlenecks

- integration of AML checks

- integration of KYC checks

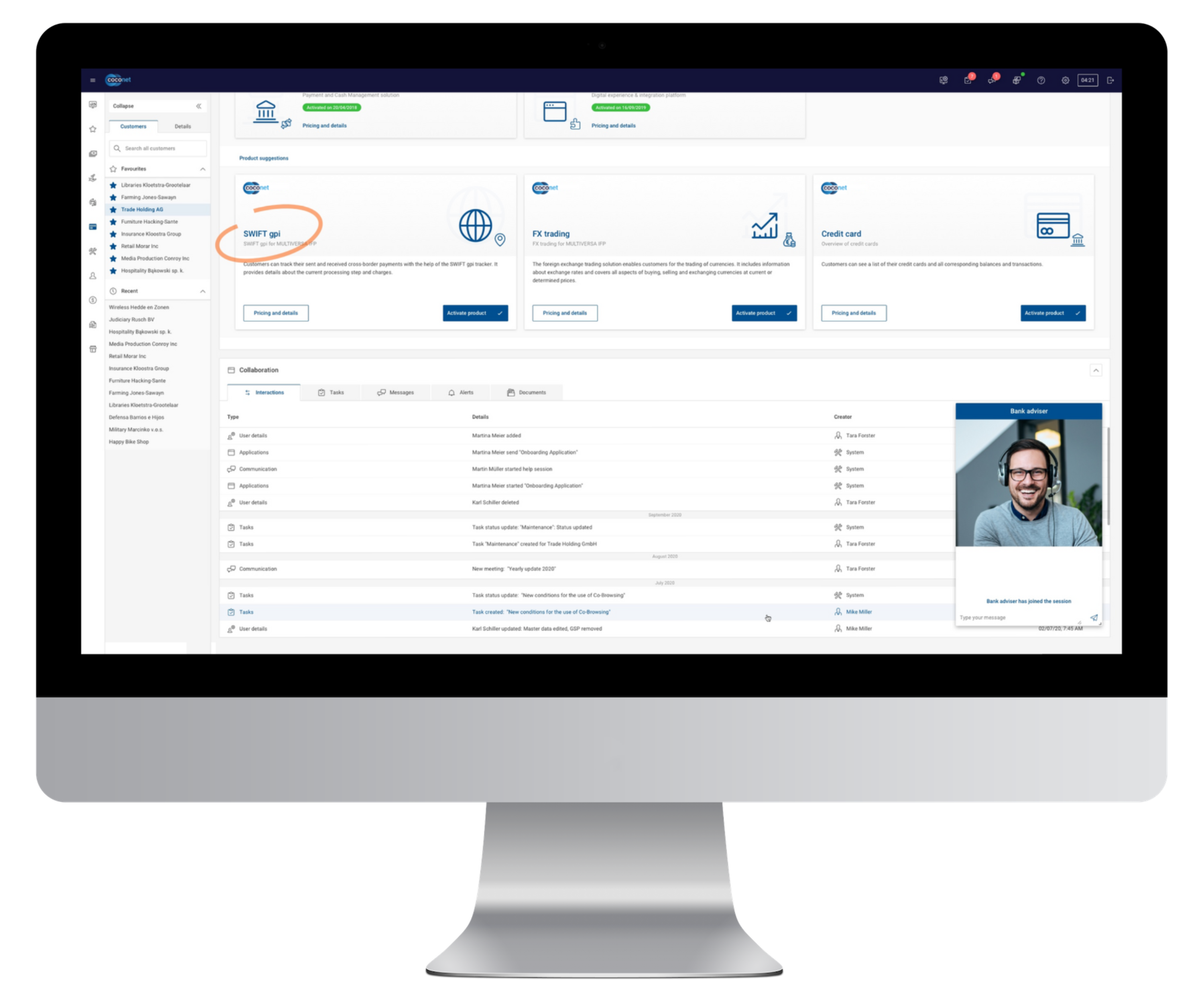

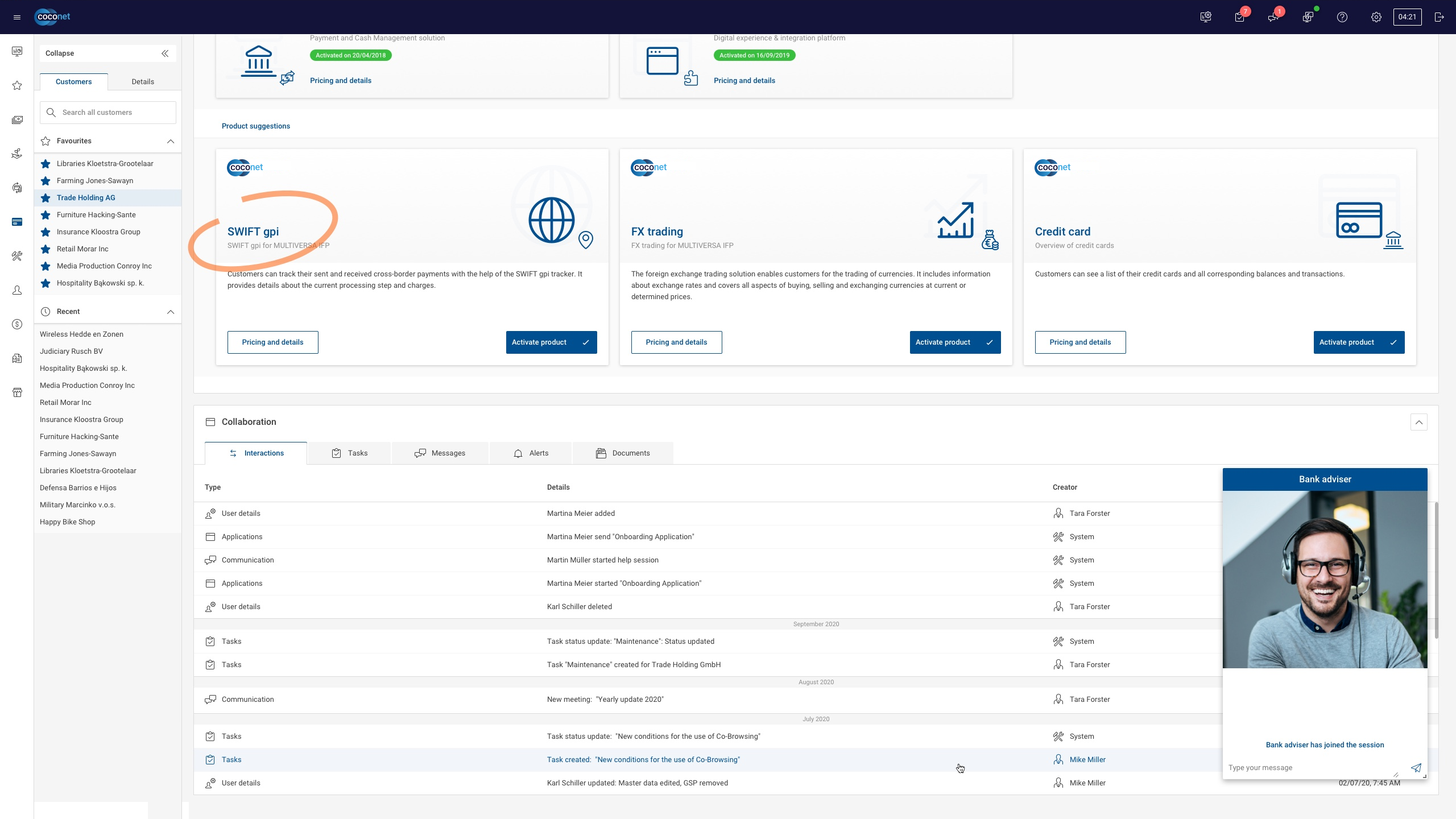

- real-time support for your clients using co-browsing features

- easy incorporation of all the bank’s divisions that are involved, such as Front and Back Office, Legal and many more

- detailed reporting options for identification and partly automatic resolution of problems

- easy scalability of workflows, ensuring the ideal user experience

Convince your corporate clients as early as the first digital contact - with multi:onboard.

multi:onboard is your bank’s new digital business card. Thanks to intuitive and easy-to-follow workflows, interested parties will become clients in next to no time. Reduce the risk of visitors not proceeding because of a lack of digital offers, and present your bank in the best light right there at first contact.

The combined client-advisor view of the onboarding process helps your advisors to support interested parties and even to take over entire process steps for the applicant. The only thing clients have to do themselves is the authentication process – but even that is child’s play, thanks to the seamless integration of tried-and-tested solutions such as IDnow, DocuSign, ZealID, BankID and others….

Onboarding of a corporate client is much more complex than retail onboarding. Thus, there is often a lack of a seamless digital onboarding experience for corporate clients. This frequently results in prospective clients losing interest in establish business relations.

Stand out from the competition and reach prospective clients even before they become your clients. Using multi:onboard, smoothly guide interested parties through the onboarding process, thus generating additional business in the long term. Your new onboarding not only saves resources because you have the option of doing completely without paper-based documentation, but also relieves your staff in the Back Office.

Are you ready for the onboarding experience of the future? Your clients most certainly are!

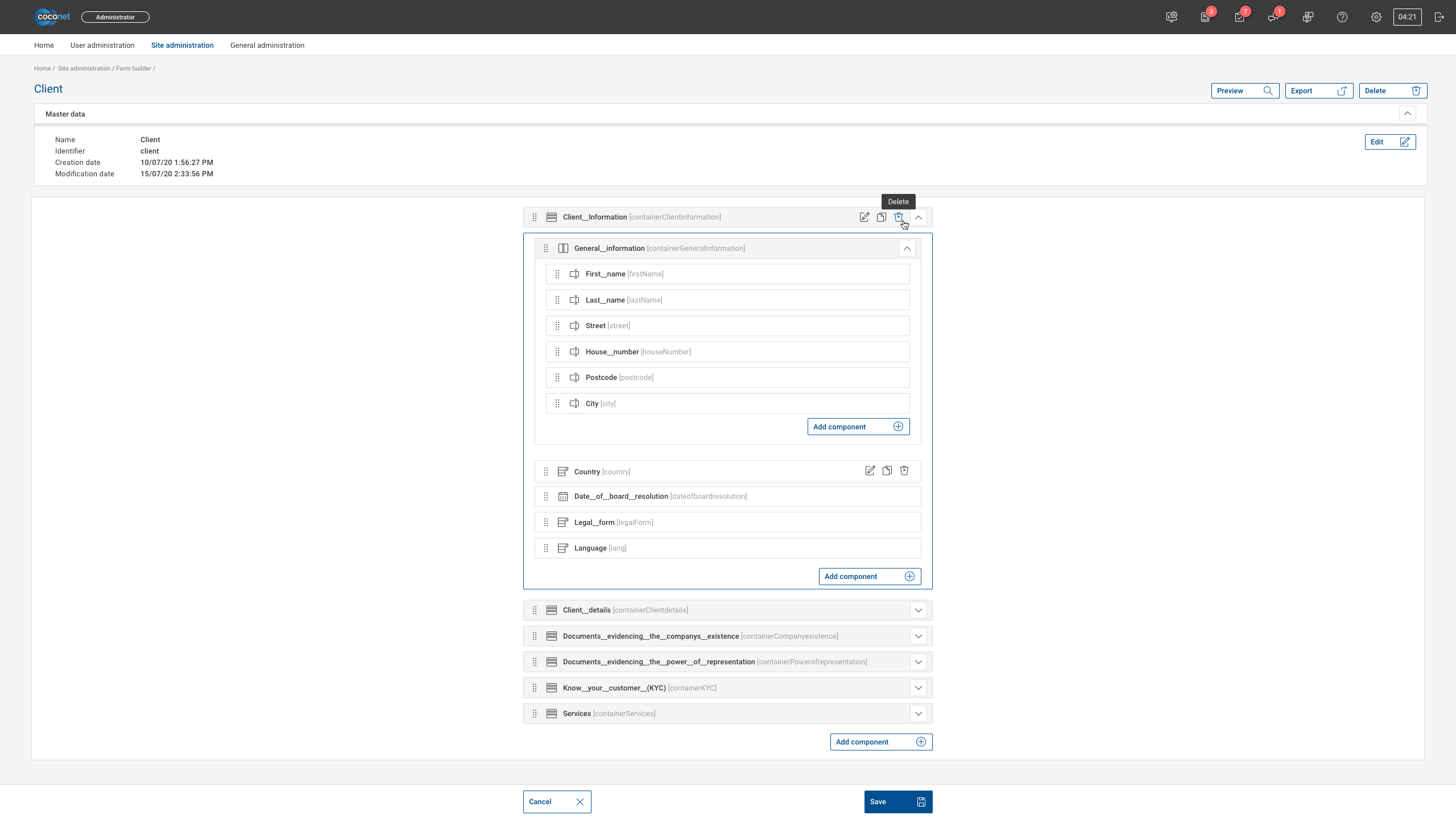

By using a workflow engine compatible with BPMN2.0 (e.g. Camunda or Pega BPM) as well as our form builder, the onboarding experience can be fully personalised and adapted without the need for coding expertise.

Create your individual procedures easily and quickly – even without advanced technical expertise.

Services can be easily integrated, based on an open, API-based solution and the use of a workflow engine. Ready-made integration packages for core banking systems, CRM, VideoIdent, eSign and QES reduce time-to-market.

Benefit from an open framework with a powerful technical foundation – and create a truly digital client experience.