coco:open stands for Open Banking, especially for corporate clients. Have you already started an Open Banking initiative and now want to integrate corporate banking more deeply? Or do you have specific requirements from innovative corporations that go beyond what’s currently possible for you?

No matter what your current situation is – we offer you comprehensive options in the short term to accelerate Open Banking for corporate clients, too! With our high-performance technology basis for all integration options and support of extensive banking APIs. And all that in parallel with existing legacy rails, such as EBICS or SWIFT in a single use case.

In addition to technological obstacles, high levels of security requirements, in particular, must be met. To establish an open bank, a flexible technology platform and an efficient partner are indispensable.

coco:open represents the technological and functional options of our product range so you can use Open Banking with your corporate clients in the best way possible.

Discover the potential of Open Banking

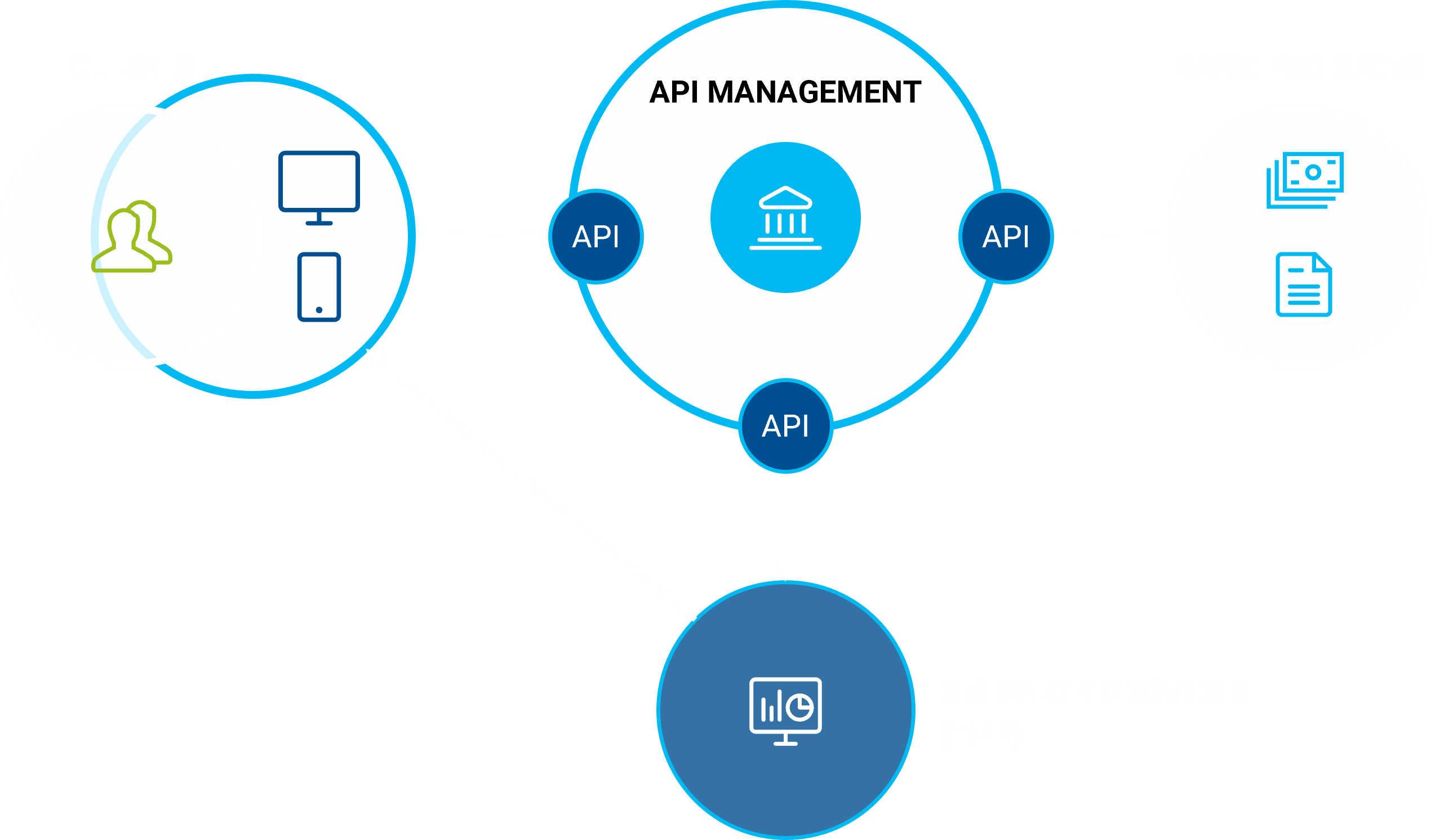

If one looks at current banking applications, from a client’s perspective, they are often individual applications with data organised in silos. The goal of Open Banking is to open up your bank and your data for your clients and their partners. You can provide data, such as transactions, account balances etc. via specific APIs such that they can be used by your clients for display, aggregation, triggering of transactions and analysis. In this way, your clients can easily expand their own business models with banking, and will therefore become more closely linked to your bank.

Using the advantages of Open Banking

At the latest within the scope of APIs (Account Information Service (AIS), Payment Initiation Service (PIS)) required by PSD2, all banks have now gained experience in the area of Open/API Banking. Many banks have already provided APIs via existing multi-banking standards in the past, of course, such as FinTS or EBICS, that allow the use of information across the boundaries of the providing bank.

This opening, which goes beyond the areas used these days, will change the banking landscape and dominant business models. With the possibilities of available APIs, clients, start-ups, fin techs and equally established product manufacturers have the opportunity to participate much more actively than before in an improvement of services for the bank’s clients.